ITR Computation Benefits | Excel Sheet Download

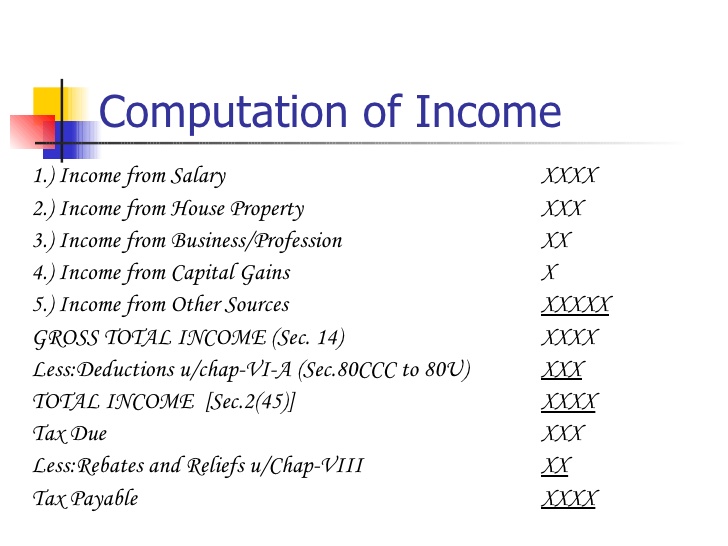

Every year, Individuals and entities in India are required to file their Income Tax Returns (ITR) with the Income Tax Department. The process of ITR computation can be complex and time-consuming, but it is important for individuals and businesses to accurately calculate their taxable income and pay the appropriate amount of taxes.

Download ITR Excel Coputation Sheet ( ✅ Free Download | ✅ Excel Format | ✅ User Friendly )

Here are some Benefits of ITR computation:

- Avoiding Penalties: Filing your ITR on time and accurately computing your taxes can help you avoid penalties and legal issues.

- Claiming Tax Refunds: By accurately computing your taxes, you can claim tax refunds that you may be eligible for.

- Financial Planning: By analyzing your income and expenses through the ITR computation process, you can plan your finances better.

To make the process of ITR computation easier, many professionals and tax experts have created Excel sheets and calculators that can be downloaded and used for free. These Excel sheets can help individuals and businesses accurately compute their taxes and file their ITR on time.

For those looking to secure a loan, ITR computation is essential. Banks and financial institutions require ITR documents as proof of income when approving loans. Accurate ITR computation can help individuals and businesses secure loans at lower interest rates.

Here are some Frequently asked questions about ITR computation:

- Who needs to file an ITR?

Individuals and entities with an annual income above a certain threshold are required to file an ITR.

- What documents are required for ITR computation?

Documents such as PAN card, bank statements, salary slips, Form 16, and other relevant financial documents are required for ITR computation.

- What is the penalty for late filing of ITR?

The penalty for late filing of ITR is subject to change each year, but it can be up to Rs. 10,000.

- Can I file my ITR without a Form 16?

Yes, you can file your ITR without a Form 16 by using your bank statements and other relevant financial documents.

In conclusion, ITR computation is a necessary and important process for individuals and businesses in India. With the help of Excel sheets and calculators, accurate computation can be made easier. Filing your ITR on time and accurately can help you avoid penalties and legal issues, claim tax refunds, and plan your finances better.

Excel Sheet for ITR Computation

Calculating income tax returns can be a daunting task, especially for those who are not well-versed in financial matters. However, with the right tools and guidance, it is possible to compute your ITR accurately and efficiently. One such tool that can come in handy is an Excel sheet designed specifically for ITR computation.

The Excel sheet is a user-friendly tool that simplifies the process of computing your tax returns. It allows you to enter your income details, deductions, and exemptions, and automatically calculates your tax liability. You can even use the sheet to compare different tax scenarios and choose the most beneficial option.

The Best part about using an Excel sheet for ITR computation is that it saves you a lot of time and effort. You no longer need to manually calculate your tax liability or worry about making mistakes. The sheet does all the heavy lifting for you, ensuring accurate and error-free calculations.

Moreover, the Excel sheet can be customized to suit your specific needs and requirements. You can add or remove fields as per your preference, and even use the sheet for multiple financial years.

In conclusion, using an Excel sheet for ITR computation is a smart and efficient way to manage your tax returns. It saves time, reduces errors, and gives you the flexibility to customize the tool to your specific needs. With this tool, you can file your returns with confidence and ease.

As for the Excel sheet download, there are several options available online. You can find free or paid versions of the sheet, depending on your budget and requirements. It is recommended to choose a reliable and trustworthy source for downloading the sheet to ensure it is safe and error-free.

Additionally, if you are taking a loan, having an accurate ITR computation can help you in several ways. It can increase your chances of getting approved for a loan, negotiate better terms, and even help you get a lower interest rate. Thus, it is essential to ensure your ITR computation is accurate and up-to-date.

Frequently asked questions (FAQs) about ITR computation:

- What is ITR computation? ITR computation is the process of calculating your income tax liability based on your income, deductions, and exemptions.

- Can I use an Excel sheet for ITR computation? Yes, an Excel sheet can be a useful tool for ITR computation. It simplifies the process and reduces the chances of errors.

- How can I ensure the accuracy of my ITR computation? To ensure the accuracy of your ITR computation, you should double-check all your inputs, use a reliable tool, and consult with a tax expert if needed.

- Is it necessary to file my ITR every year? Yes, if your income exceeds the taxable limit, you are required to file your ITR every year.

- How can I use my ITR computation for loan applications? Having an accurate ITR computation can increase your chances of getting approved for a loan, negotiate better terms, and get a lower interest rate.