Nidhi Company Compliances

Navigating Nidhi Company Compliances: A Comprehensive Guide with FAQs

Introduction

Running a Nidhi company involves adhering to specific regulatory requirements to ensure transparency and trust among members. This guide provides a detailed overview of Nidhi company compliances, offering step-by-step insights into the compliance process and addressing frequently asked questions (FAQs). By understanding and implementing these compliances, Nidhi companies can uphold their financial integrity and maintain credibility.

Understanding Nidhi Companies and Their Importance

- Defining Nidhi Companies:

- Understanding the concept of Nidhi companies as non-banking financial institutions primarily dealing with their members’ funds.

- The key characteristics that distinguish Nidhi companies from other types of financial entities.

- Importance of Compliances in Nidhi Companies:

- Highlighting the significance of adhering to regulatory compliances for Nidhi companies.

- Building trust among members, ensuring legal standing, and fostering long-term sustainability.

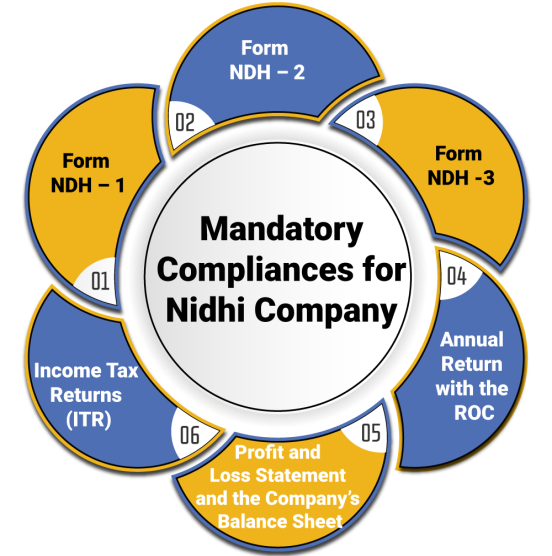

Key Nidhi Company Compliances: A Step-by-Step Guide

- Incorporation Compliances:

- Step-by-step guidance on the procedures and documentation required for incorporating a Nidhi company.

- Compliance with the Companies Act and the specific regulations governing Nidhi companies.

- Membership and Shareholding Compliances:

- Ensuring compliance with regulations related to membership, shareholding, and share capital.

- Addressing restrictions on the transfer of shares among members.

- Deposit Compliances:

- Guidelines for compliance with deposit-related regulations, including the acceptance and repayment of deposits.

- The maximum limit on deposits, interest rates, and the creation of a Deposit Repayment Reserve.

- Financial Statement Compliances:

- Preparing and filing financial statements as per the prescribed formats and timelines.

- Compliance with auditing requirements and the appointment of auditors.

- Board and Member Meeting Compliances:

- Ensuring regular board and member meetings as required by law.

- Compliance with notice periods, quorum requirements, and recording minutes of meetings.

FAQs About Nidhi Company Compliances

- What is the minimum capital requirement for incorporating a Nidhi company?

- The minimum capital requirement for a Nidhi company is specified in the Companies Act, and it varies based on the company’s location.

- Are there restrictions on the type of deposits a Nidhi company can accept?

- Yes, Nidhi companies are restricted in the types of deposits they can accept, primarily from their members.

- How frequently should financial statements be filed, and what is the audit requirement?

- Financial statements must be filed annually, and Nidhi companies are required to undergo an annual audit.

- Can a Nidhi company change its registered office address?

- Yes, a Nidhi company can change its registered office address, but it must comply with the legal procedures and notify the concerned authorities.

- What penalties can be imposed for non-compliance with Nidhi company regulations?

- Penalties for non-compliance may include fines, legal actions, and potential closure of the Nidhi company.

Common Challenges and Solutions in Nidhi Company Compliances

- Keeping Up with Regulatory Changes:

- Staying informed about changes in regulations by regularly monitoring updates from regulatory authorities.

- Engaging legal professionals for timely advice on evolving compliance requirements.

- Maintaining Accurate Records:

- Implementing robust record-keeping systems to ensure accurate documentation of all transactions and compliances.

- Conducting periodic internal audits to verify the accuracy and completeness of records.

Benefits of Strict Nidhi Company Compliances

- Enhanced Credibility and Trust:

- Adhering to compliances enhances the credibility of the Nidhi company, fostering trust among members and stakeholders.

- Legal Standing and Sustainability:

- Complying with regulatory requirements ensures the Nidhi company’s legal standing, contributing to its long-term sustainability.

Conclusion: Upholding Integrity Through Compliances

In conclusion, strict adherence to Nidhi company compliances is integral to maintaining financial integrity and trust. This guide offers a comprehensive roadmap, addressing FAQs, potential challenges, and the benefits associated with complying with regulatory requirements. By navigating Nidhi company compliances diligently, companies can uphold their commitment to transparency and ensure a robust financial foundation.